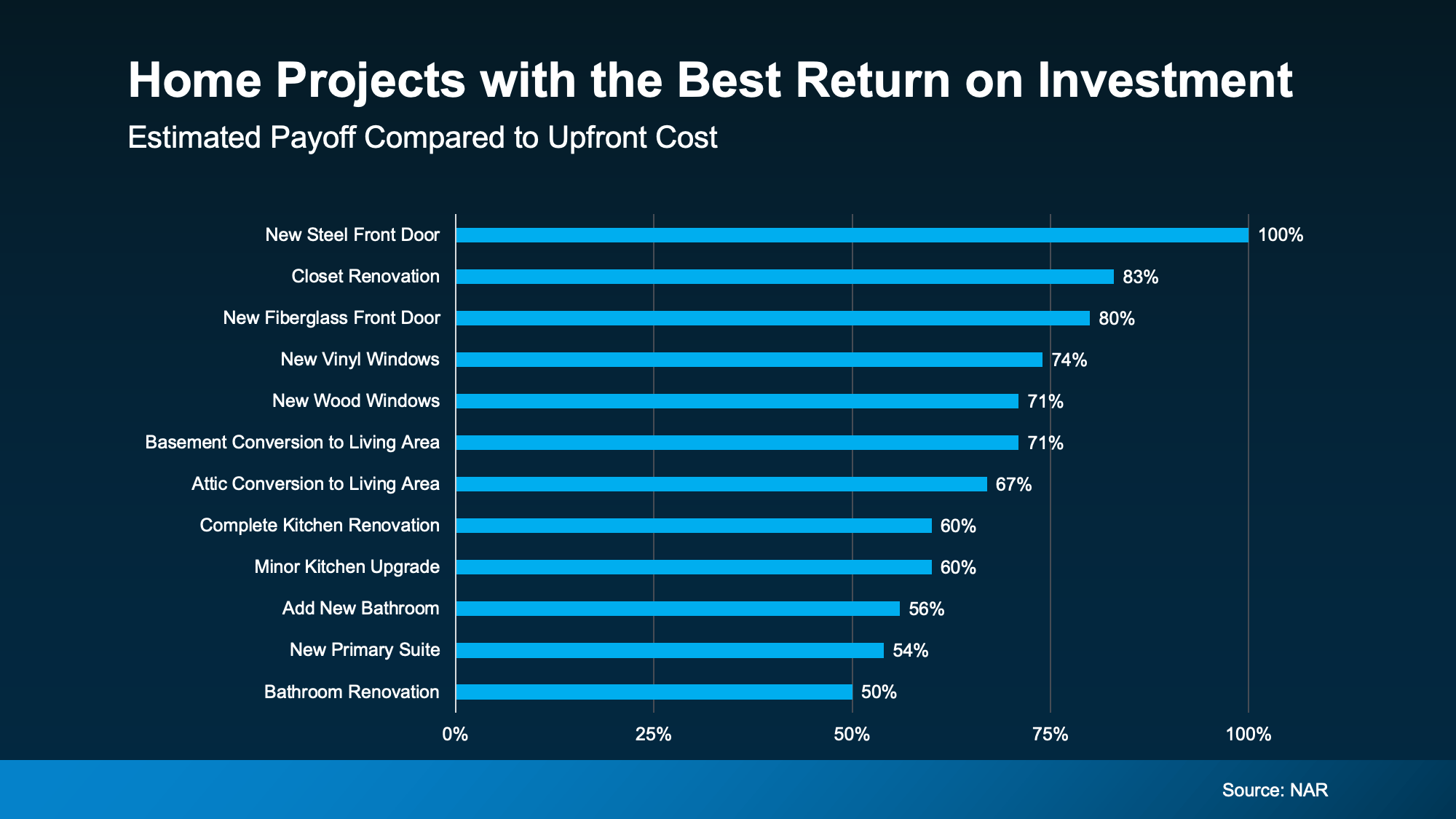

Home Projects That Boost Value

Whether you’re planning to move soon or not, it’s smart to be strategic about which home projects you take on.

Why You’ll Want a Home Inspection

An inspection is your chance to avoid costly headaches and get peace of mind. Connect with an agent to talk about other ways to make your offer stand out....

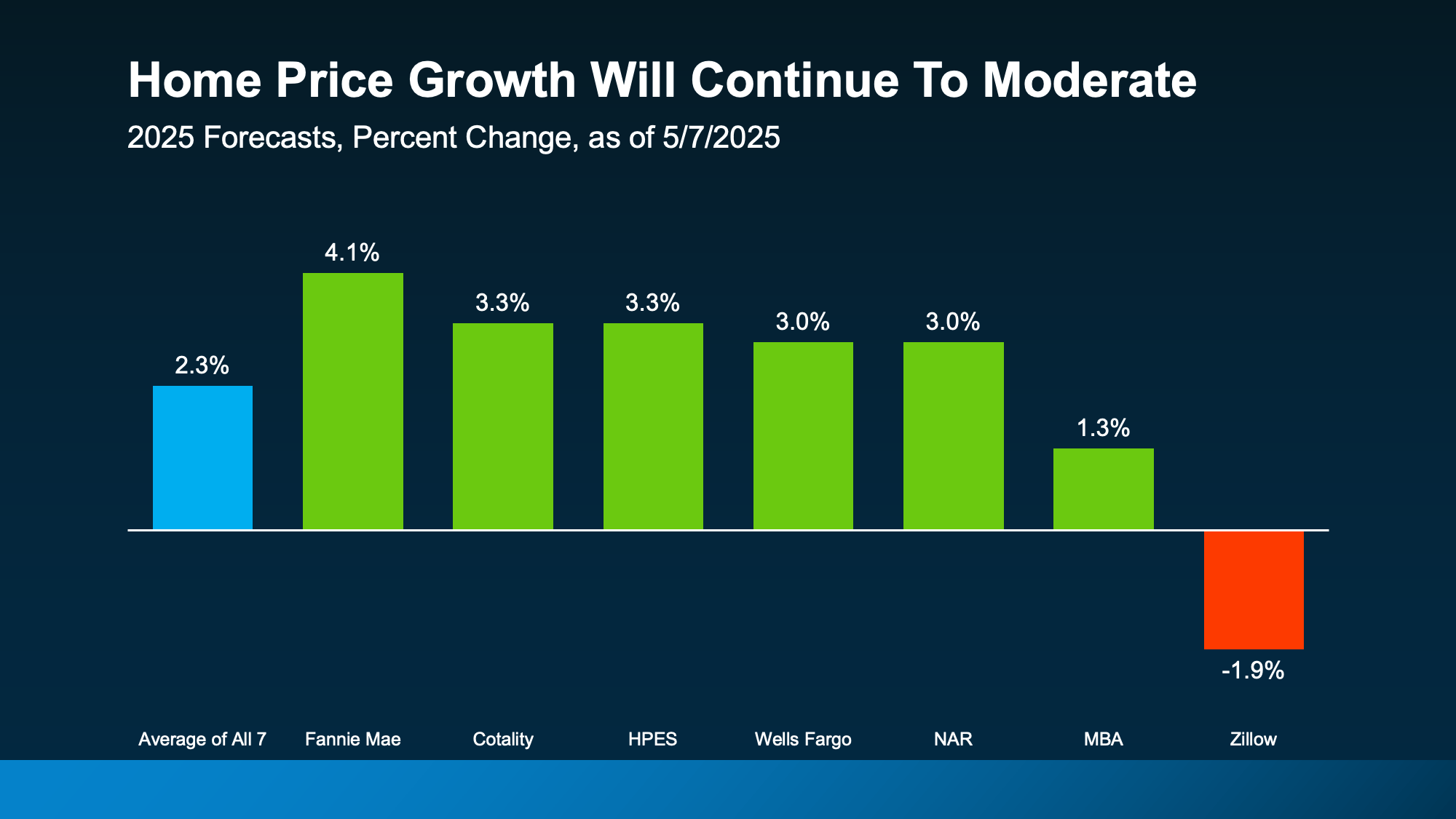

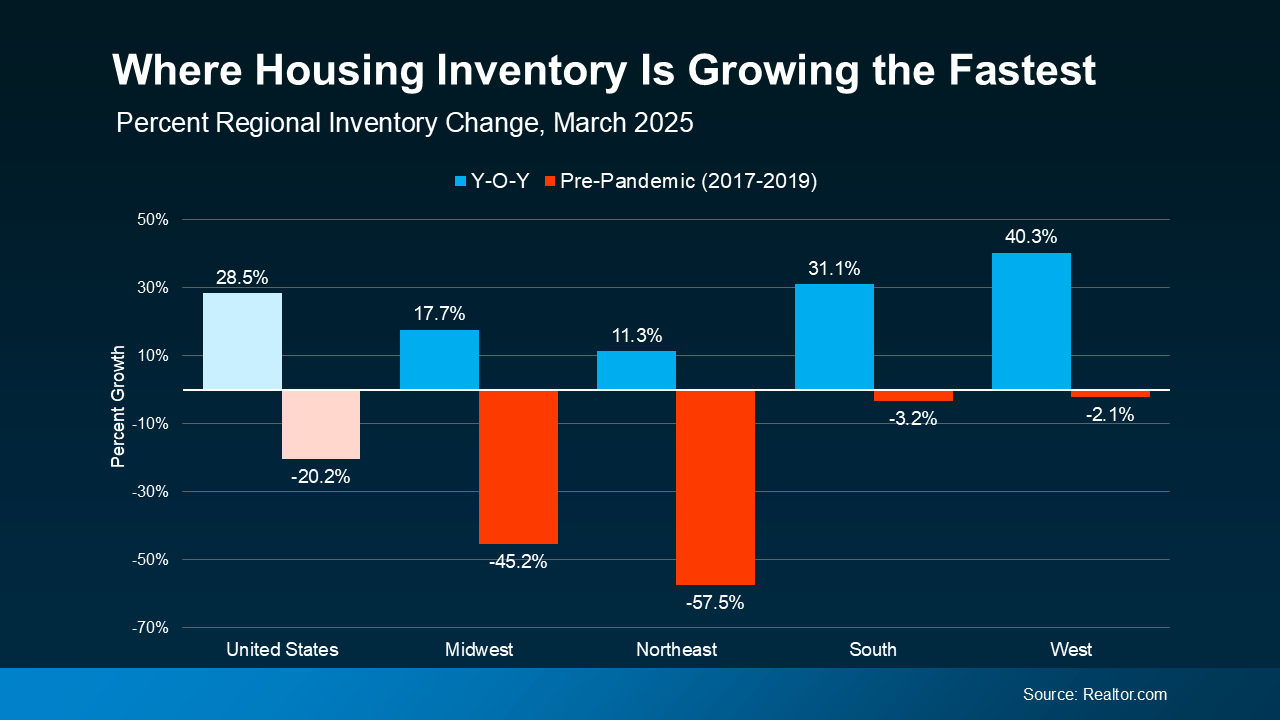

Housing Market Forecasts for the Second Half of the Year

From rising home prices to mortgage rate swings, the housing market has left a lot of people wondering what’s next – and whether now is really the right time to move....

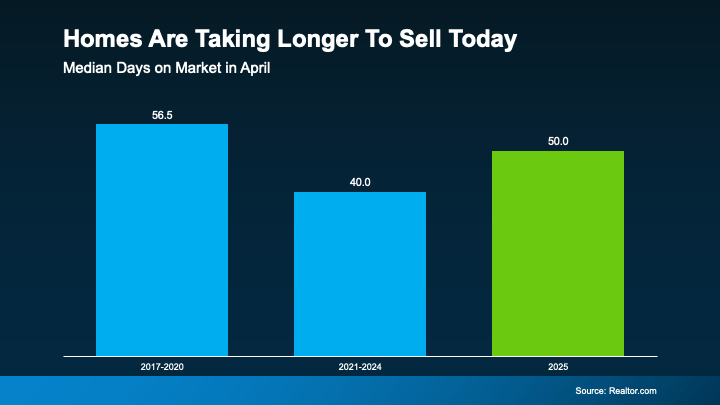

Why Some Homes Sell Faster Than Others

As you think ahead to your own move, you may have noticed some houses sell within days, while others linger....

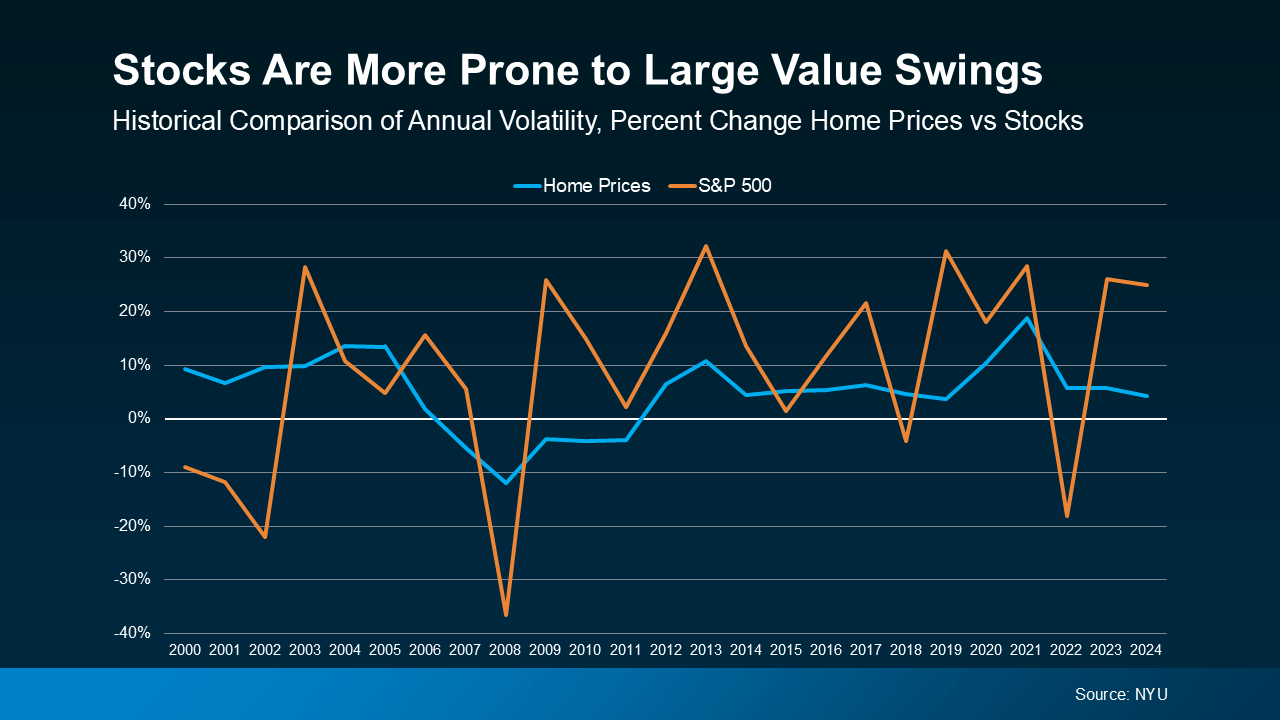

Stocks May Be Volatile, but Home Values Aren’t

With all the uncertainty in the economy, the stock market has been bouncing around more than usual....

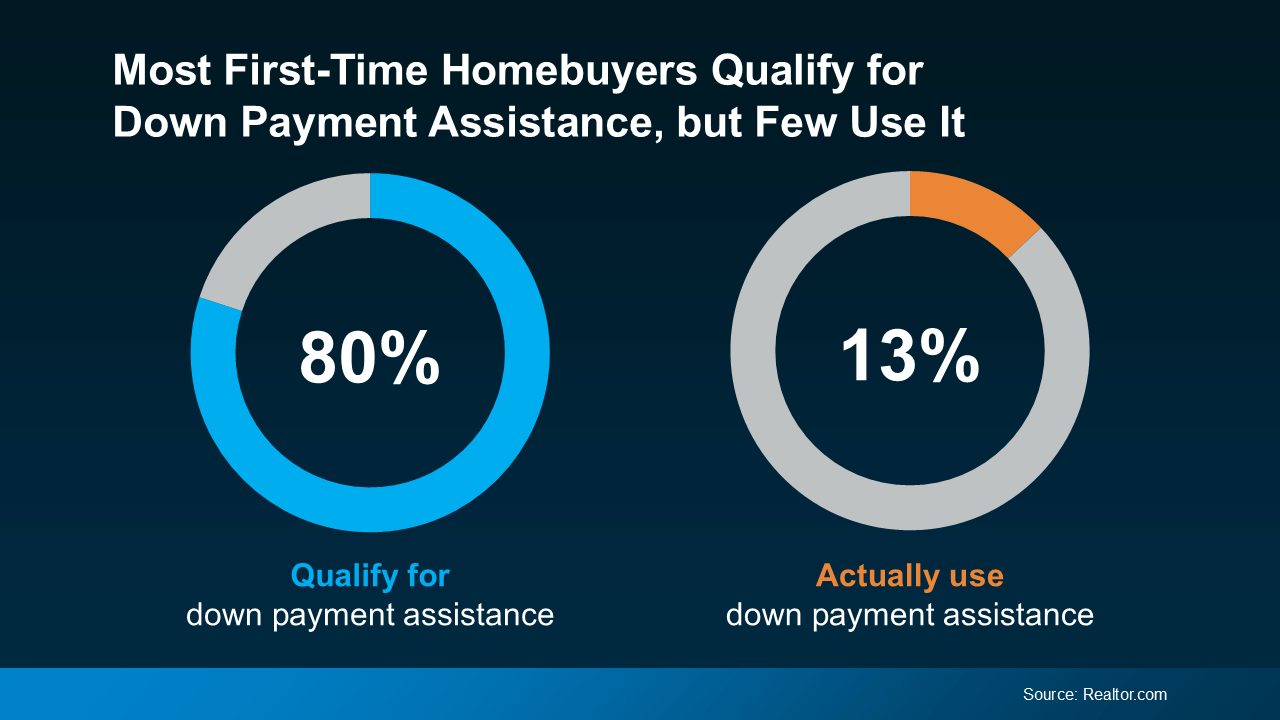

The 20% Down Payment Myth, Debunked

Saving up to buy a home can feel a little intimidating, especially right now.

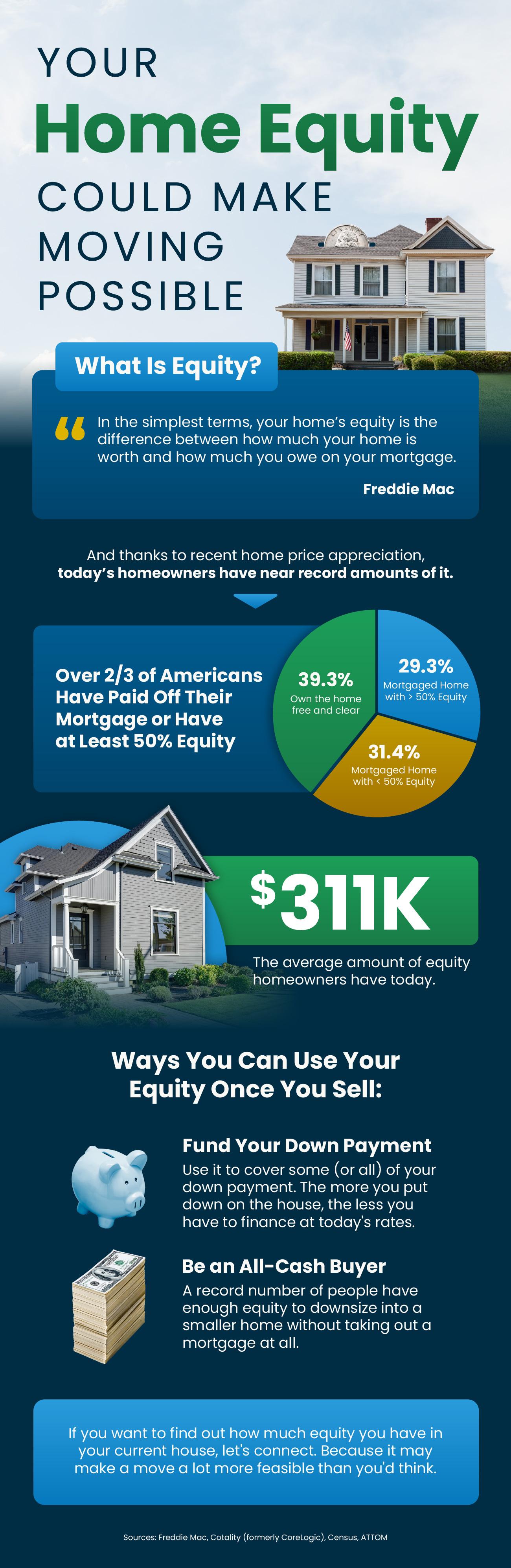

Your Home Equity Could Make Moving Possible

Thanks to recent home price appreciation, homeowners have near record amounts of equity – and you may too. On average, homeowners have $311K worth of equity....

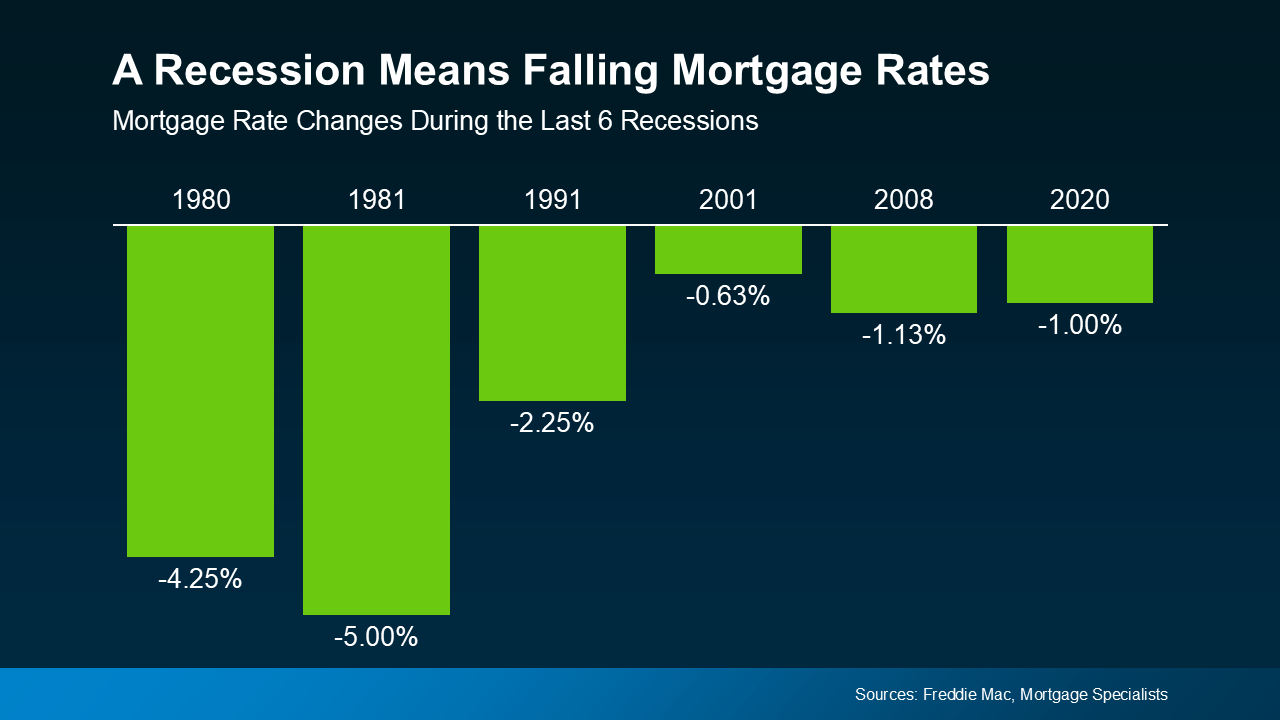

What an Economic Slowdown Could Mean for the Housing Market

Talk about the economy is all over the news, and the odds of a recession are rising this year....